If there was ever a year to be in the datacentre business, 2020 was it.

As the coronavirus pandemic spread its ugly tentacles across the planet, a wholesale shift to working and schooling from home placed unprecedented demands on cloud computing and, in turn, data centre infrastructure.

Andrew Schaap - CEO of Aligned Energy, a major infrastructure technology company committed to solving the world's toughest sustainability challenges associated with data centre infrastructure, energy consumption and water usage – said that 2020 has seen the realization of digital transformation sooner than many expected.

“From Microsoft adding 12 million users to its Teams platform in one week to the explosion of AI and machine learning, we've seen a massive uptick in utilization across the board.” [1]

Along with that increase came massive growth in data centre investment and development – both in the US and in Europe - with the burst of activity being fuelled by huge demand for data centre capacity. Even in what we might deem ‘normal times’, datacentres are an industry of incredibly low churn – three per cent or less. Procedural complications and prohibitive moving costs - coupled with the huge gains to be made - mean that while there is a large and rapidly growing number of potential buyers, there are few if any sellers of existing assets.

Perhaps that is why hyperscale datacentres are springing up at an impressive rate. Although facilities had been creeping closer to “the edge” (nearer the end user), the building of datacentres still tends to cluster in what is called FLAP or FLAP+D: Frankfurt, London, Amsterdam and Paris, plus Dublin.

Worldwide, cloud services are expected to attract 14 per cent of the global IT spend next year, up from nine per cent in 2020. In Europe, the cloud market is projected by Gartner to be €76bn in 2021, an increase of 13.7 per cent over 2020. [2]

The datacentre industry’s expansion in Europe has doubtless also been accelerated by the GDPR rules requiring European personal and critical business data to stay in Europe.

As a result, London is only expected to grow by an annual rate of around 7.6 per cent to 2025, while Amsterdam has overcome local planning objections to datacentres, which are forecast to grow 18.9 per cent over the same period.

Wayne Powell, Regional Sales Manager – EMEA, Industrial Disinfection at Evoqua Water Technologies, says that helping to look after datacentre and facilities’ growth is needed to keep our increasingly online world up and running.

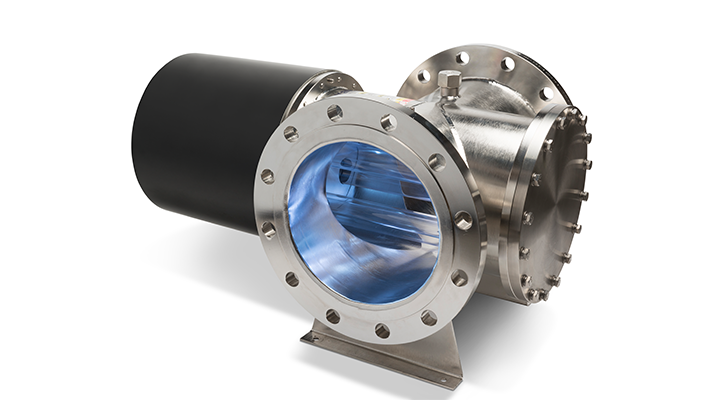

“Evoqua’s multi-technology water-cooling treatment systems play a critical role in keeping our client’s data centres operational.

“The advantages and benefits of our sustainable, ‘green’ technologies like the combination of non-chemical UV disinfection and advanced filtration or the safety and security of on-demand produced OSEC® Disinfection systems, means we are 100% in step with the growth of data centre expansion worldwide – especially in the larger, hyperscale constructions.

“We provide the invisible magic that keeps these buildings running whilst at the same time, reducing energy usage and handling of bulk hazardous chemicals, improving the quality of utility water and extending the life of water treatment and cooling equipment.

“If the last year has taught us nothing else, it’s how to adapt. The growing need for remote management of IT assets looks set to continue, and we’ll be working hand in hand with our clients to make that happen,” says Powell.

[1] www.bisnow.com / https://bit.ly/3rf9Hf2 / https://www.insider.com / https://bit.ly/2Z2eiFc

[2] https://www.ft.com / https://on.ft.com/3pRXRqY

The attributed opinions in this blog post are not necessarily those of Evoqua.

Connect with Wayne Powell on LinkedIn.